To ensure that UTokyo students do not abandon their studies for financial reasons

About the Learning Support Fund

The Learning Support Fund is intended to provide support for students who are experiencing financial difficulties in pursuing their studies in relation to the following projects. Your support will be used to help motivated and capable students achieve their educational aspirations.

・Exemption in whole or in part from admission fees, tuition, or dormitory fees

・Loans or grants to cover school-related expenses

・To cover expenses incurred in connection with students’ overseas study

・To cover reimbursements for the work of teaching assistants and research assistants

The Emergency Student Support Package

In 2020, the University of Tokyo put in place an Emergency Student Support Package to provide aid to students who were experiencing hardship due to sudden changes in family finances or a loss of part-time work income, or who were experiencing significant difficulties in their studies and research activities amid the upheavals to social and economic activities caused by the spread of COVID-19.

Through the Emergency Student Support Package, the University of Tokyo allocated JPY 43,450,000 in scholarship grants from the Learning Support Fund for 869 motivated and capable students to enable them to achieve their educational aspirations.

For more details, please click here (Activity Report).

Although we have already provided scholarships to students in urgent need, the prolonged impact of the COVID-19 pandemic is inevitable, and long-term and continuous support for UTokyo students in need of financial assistance is still required.

We would like to ask for your generous support in this endeavor.

Corporations and organizations that have donated JPY 500,000 or more

・Kawata Orthopedics, an Eikei-kai Medical Corporation

・International Society for Pharmaceutical Engineering (ISPE) Japan Affiliate

・Sumitomo Mitsui Construction UTokyo Alumni Association for Civil Engineering and Social Infrastructure

・Kansai UTokyo Alumni Association (Kansai Todai-kai)

・Applied Corporation

(In order of contribution)

Thank you very much for your earnest support.

Tax Incentives

For Donations from Individuals

Thanks to the 2008 revision of Japan’s tax system, donations by individuals to the Learning Support Fund of a national university corporation or similar organization are now eligible for a tax credit as well as for the pre-existing income deduction. Since donations to UTokyo’s Learning Support Fund fall into this category, please choose either the income deduction or the tax credit when filing your tax return, whichever is more advantageous.

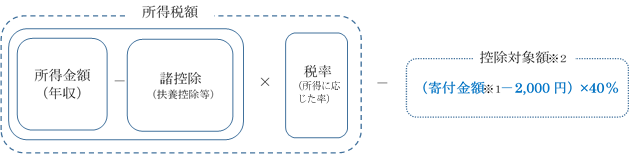

■Tax Credit

This is a system whereby a set percentage of the amount donated by an individual can be directly deducted from the income tax amount. Since the tax credit is deducted directly from the income tax amount regardless of the tax rate, the tax benefit will be greater for many people than the income deduction credit.

Income Tax Amount

(Taxable Income (Annual Income)) – Deductions (Allowance for Dependents, etc.)) x Tax Rate (According to Income) – Eligible Deduction2 (= (Donation Amount1 – JPY 2,000) x 40%)

1 If the donation amount exceeds 40% of your gross income for the year in question, the amount equal to 40% of your gross income can be deducted from your taxes.

2 The amount eligible for the tax credit is limited to 25% of the income tax amount for the year in question.

When you file your tax return, you will need to submit a donation receipt and a copy of the Certificate Related to Tax Deduction. A copy of this certificate will be issued together with the donation receipt.

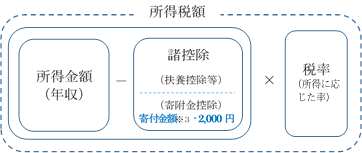

■Income deduction

The donation amount is multiplied by the tax rate based on the donor individual’s income to determine the deductible amount. If the donation amount is large in relation to the individual’s total income, it may be more advantageous to use the income deduction method, which can exceed the maximum deduction amount using the tax credit method.

Income Tax Amount

(Taxable Income (Annual Income)) – Deductions (Allowance for Dependents, etc. / Donation Deduction) (= (Donation Amount3 – JPY 2,000)) x Tax Rate (According to Income)

3 If the donation amount exceeds 40% of your gross income for the year in question, the amount of donation equal to 40% of your gross income will be eligible as an income deduction.

Estimated income tax refund when filing a tax return

(This guideline should be used for reference purposes only)

(Unit: JPY)

| Amount of Taxable Income (JPY) | Income Tax Rate | Deduction Method | Donation Amount (JPY) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 10,000 | 50,000 | 100,000 | 30,000 | 1 million | 5 million | 10 million | |||

| 1.5 million | 5% | Income | 400 | 2,400 | 4,900 | 14,900 | 49,900 | 69,377 | 69,377 |

| (≤195) | Tax | 3,200 | 18,750 | 18,750 | 18,750 | 18,750 | 18,750 | 18,750 | |

| 3 million | 10% | Income | 800 | 4,800 | 9,800 | 29,800 | 99,800 | 158,560 | 158,560 |

| (≤330) | Tax | 3,200 | 19,200 | 39,200 | 50,625 | 50,625 | 50,625 | 50,625 | |

| 5 million | 20% | Income | 1,600 | 9,600 | 19,600 | 59,600 | 199,600 | 476,560 | 476,560 |

| (≤695) | Tax | 3,200 | 19,200 | 39,200 | 119,200 | 143,125 | 143,125 | 143,125 | |

| 7 million | 23% | Income | 1,840 | 11,040 | 21,100 | 61,100 | 201,100 | 762,123 | 762,123 |

| (≤900) | Tax | 3,200 | 19,200 | 39,200 | 119,200 | 243,500 | 243,500 | 243,500 | |

| 10 million | 33% | Income | 2,640 | 15,840 | 32,340 | 98,340 | 329,340 | 1,191,100 | 1,242,865 |

| (≤1,800) | Tax | 3,200 | 19,200 | 39,200 | 119,200 | 399,200 | 441,000 | 441,000 | |

| 30 million | 40% | Income | 3,200 | 19,200 | 39,200 | 119,200 | 399,200 | 1,999,200 | 3,999,200 |

| (≤4,000) | Tax | 3,200 | 19,200 | 39,200 | 119,200 | 399,200 | 1,999,200 | 2,301,000 | |

| 50 million | 45% | Income | 3,600 | 21,600 | 44,100 | 134,100 | 449,100 | 399,200 | 4,499,100 |

| (≥4,000) | Tax | 3,200 | 19,200 | 39,200 | 119,200 | 2,249,100 | 1,999,200 | 3,999,200 | |

More advantageous to use tax credits

More advantageous to use deductions from income

For corporate donations

In accordance with Article 37, Paragraph 3, Item 2 of the Corporation Tax Act, the full amount of the donation is allowable as a tax-deductible expense.

Project Leader

Yuko FUJIGAKI

Executive Vice President

The University of Tokyo